Data Watch: Houzz Renovation Barometer Shows a Return to Normal

The home renovation industry is roaring back to life. When asked how revenues and profits this year compare with pre-recession levels, most professionals gave a big thumbs-up. “A large majority of home renovation firms on Houzz report a return to pre-recession revenues and profits, irrespective of industry segment or firm size,” says Nino Sitchinava, principal economist at Houzz. “While industry confidence remains strong for the remainder of 2015, professionals tell us that the shortage of skilled labor continues to be a key challenge to growth.” Other challenges include longer lead times, and price increases, says a home builder in Oregon.

As fall approaches, typical seasonal patterns are likely to play out, with landscape and other outdoor professionals expecting declines and interior design firms expecting gains in business activity over the next three months. The other professional groups remain optimistic that the next quarter will see the current high levels maintained.

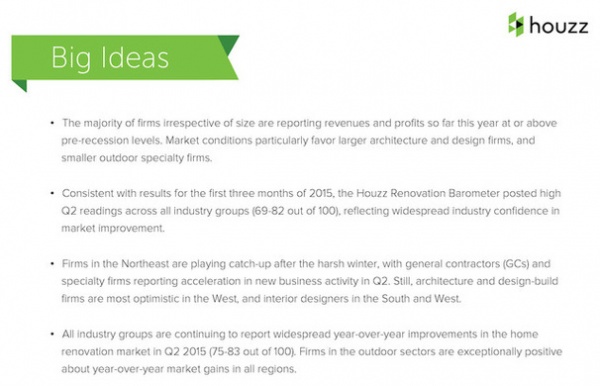

Back to ‘Normal’ (and Then Some)

Most home renovation firms that have profiles on Houzz reported that conditions have returned to levels that are about the same or better than pre-recession “normal” levels.

Furthermore, 20 percent or more of firms in all industry sectors reported that revenues and profits are significantly above the pre-recession normal levels. The one group missing the mark (architectural firms) barely missed, with 19 percent reporting significantly better net profits.

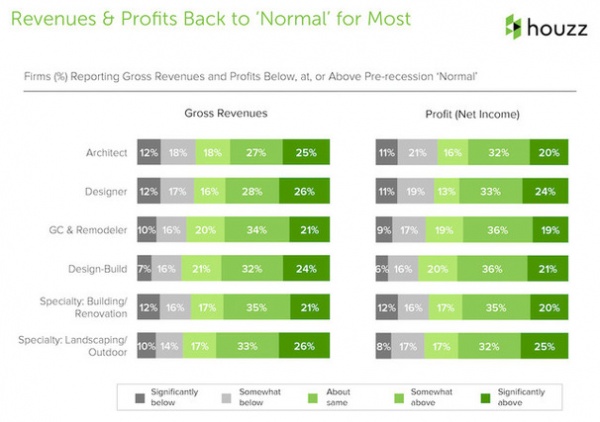

A Bright Future

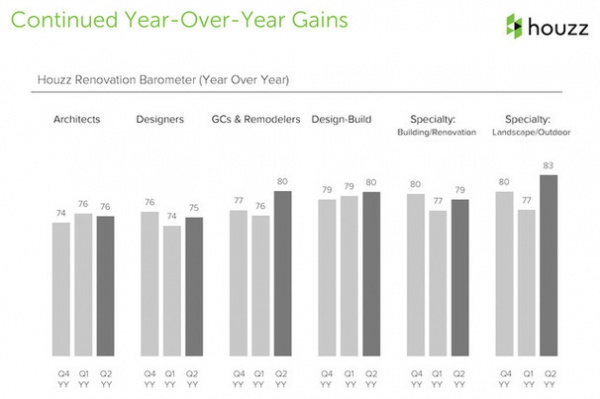

This graph shows that for the third quarter in a row, there were quarter-over-quarter gains in business activity among nearly all the professional groups surveyed (a slight decline was reported by architectural firms).

Basically, an index number higher than 50 means that more professionals reported an increase in business activity than those who reported a decline. The higher the number, the more the increase in activity.

Above you can see that the index numbers for all professionals in the second quarter range from 70 for architectural firms to 82 for landscape and outdoor firms. Design firms saw the biggest gain for the quarter, jumping 6 points, from 73 to 80.

Market conditions are largely expected to remain steady in the third quarter, with index levels ranging from 69 to 80.

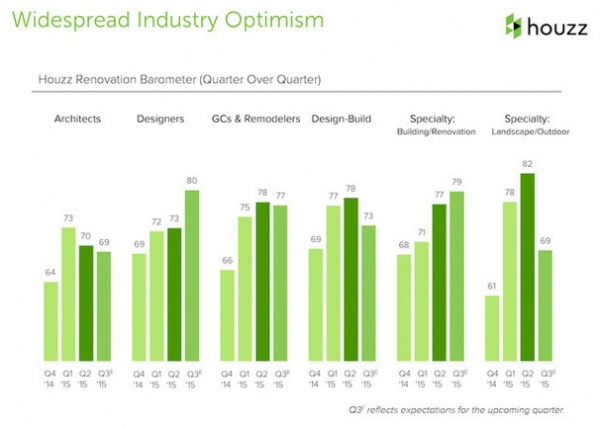

Widespread Growth

This graph breaks down the increases across key business activities, which are the number of inquiries professionals receive about potential projects, the number of new projects they secure and the size of those projects.

All industry groups saw a widespread increase in new business activity over the last quarter.

Meanwhile, the graph shows that the majority of business groups expect similar levels of activity for the third quarter of 2015. The only group that expects a significant decline in the number of new inquiries and the number and size of new projects is landscape design, which may be due to the start of the seasonal slowdown.

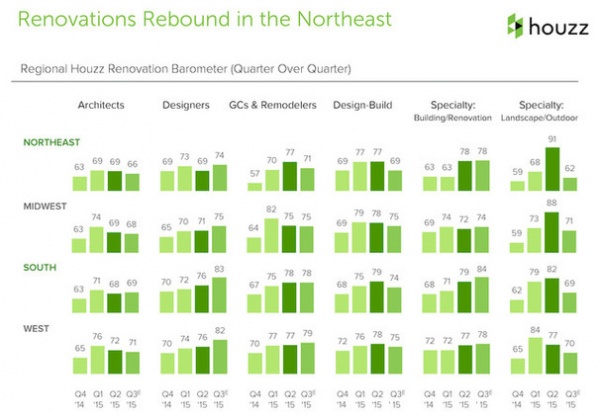

Seasonal Changes

After a harsh winter in the Northeast that affected business activity during the past two quarters, warmer weather led to large gains for the region’s remodeling and landscape firms. However, with the potential for cooler weather returning in the third quarter, optimism for business activity in landscape design is lower across the entire country, but most notably in the Northeast, which has been hit by severe winters the past two years.

Conversely, with cooler weather likely to encourage people to head indoors, interior design firms across all regions of the country expect business activity to grow in the third quarter of 2015.

Growth Spurt

While the majority of professional groups reported a third consecutive quarter of increased growth, perhaps even more important, nearly all firms have also continued to see year-over-year gains.

Maintaining Momentum

To sum it up, the majority of the home renovation industry has now reached pre-recession levels or above. Moving forward, challenges still remain (namely, skilled labor shortages), but optimism is strong in nearly all sectors, with the belief that the current high levels will be maintained.

Pros: What is your business outlook for the coming months?

More: Find home improvement and design pros near you